Parity in the NHL - Not financially

Posted 12:21 PM ET | Comments 4

With my local home team out of the playoffs after a mostly successful season, you can understand how attention has turned to the completed sale of the team and toward potential moves the team may make for next season. There have been many articles written about the financial struggles and questionable long-term profitability of teams like the Blues and Coyotes. Articles are now surfacing that astutely consider the impact the impending CBA renewal might have on various clubs’ foreign prospects. In an interesting twist of fate but mostly due to the hard work of the teams, the small market, NHL-owned Coyotes are facing the huge market Kings in the conference finals. This discussion prompted me to turn my attention to the economics of the league, hoping to gleam some insightful information regarding the past CBA and to create some productive dialogue for the new CBA.

In order to gain some insight, I focused my attention on data gathered from the 2009-10 and 2010-11 seasons as published by Forbes (www.forbes.com) and Capgeek (www.capgeek.com). I focused on revenue, player expense (includes benefits and bonuses), and operating income from Forbes and Capgeek’s “spending” amount. From this data, I computed the player cost percentage or “PCP” (the average of Forbes’ player expense and Capgeek’s spending divided by Forbes revenue and yes there could be at least a few jokes or irony with the acronym).

Analyzing the data provides some telling information:

1) Generally, two thirds of the teams fall below the average revenue per team (20 teams in 2011 and 19 teams in 2010) with the lowest team accounting for about 2% of total team revenue while the highest is more than 3x that at over 6%.

2) The largest revenue team had a PCP of 30% while other teams reached as high as 73%. Without the actual data, one might assume this disparity is just a case of extremes and limited to a few teams. Further analysis of the shows this is not the case. In 2011, 53% of the teams in the league had a PCP that was more than twice that of the highest revenue team. When reviewing 2010, it proves 2011 was not an aberration as the same statistic held true for 47% of the teams.

3) The top three teams in operating income average around $58 million per year while the rest of the league averages an operating loss of $780,000 per year.

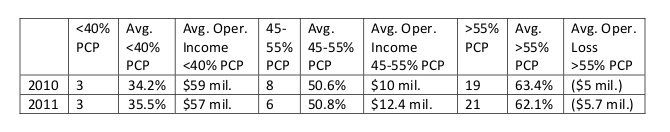

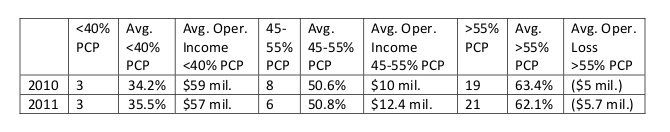

4) When looking at groupings within the Player Cost Percentage, you can note the following:

5) More than 73% of the teams had operating income of less than $3.3 million with 60% of the teams sustaining an operating loss in 2012. The teams fared better in 2011 with only 63.3% of the teams having operating income of less than $2.7 million and only 53.3% of them sustaining an operating loss.

Does this surprise any of you? Being in a smaller market NHL city, the results were much like I expected. More importantly: what all does this suggest?

1) For 20-30% of the league, there is no need for a salary cap but for everyone else the cap could be critical to sustainability.

2) The same teams mentioned in item 1 dominate the profitability and revenue of the league. By doing so, they drive the salary cap and floor to a level that causes most of the remaining teams to lose money, maybe even calling the long term sustainability of some of the teams into question. In this case, the poor to get poorer as the rich get richer.

3) Historically, the NHLPA has been more than happy with this system because as the large revenue teams keep juggernauting ahead, they force the smaller teams to raise salaries even if their business models can’t tolerate the salary increases. While this is great in the short term as it increases overall NHLPA compensation, it can be very detrimental in the long term. If you don’t believe me, ask some players of the WHA or the ABA who were not able to find a home on an NHL or NBA team.

4) The aforementioned items truly illustrate the need for revenue sharing and it isn’t clear if the existing revenue sharing is included in the Forbes revenue numbers. If it is, I shudder to think what the numbers would look like without it. If it doesn’t I wonder how that would improve the profitability of the lower teams.

5) We can assume the league will use this data to show how a lot of teams are losing money and need the salary cap lowered. The NHLPA will use this to show the overall profitability of the league and illustrate how some teams are doing very well wanting the “have” teams to share with the “have nots” in a larger way while keeping the player’s salary cap climbing. Interestingly, this issue shows just another illustration of the three financial struggles in the NHL – players vs. players; teams vs. teams; and teams vs. players but that conversation is for a later day.

I realize that the numbers presented by Forbes have to be taken with grains of salt and can vary significantly based on how certain revenue is split, especially among related entities but that is a very complex conversation not to be had in this blog especially when we are limited by the data we can obtain. I’ve been giving given the data considerable thought and have been developing my own CBA financial plan, which of course will be ignored by everyone. I’ll post it in a few days to get your comments.

As always, it’s a great day for hockey and here’s to hoping that day continues into the 2012-13 season.

PS - If the finances of the game interest you, please consider reading Bruce Dowbiggin’s book – Money Players : How Hockey’s Greatest Stars Beat the NHL at its Own Game. Realize that Bruce wrote that book in 2003, well before the lockout.

data:

In order to gain some insight, I focused my attention on data gathered from the 2009-10 and 2010-11 seasons as published by Forbes (www.forbes.com) and Capgeek (www.capgeek.com). I focused on revenue, player expense (includes benefits and bonuses), and operating income from Forbes and Capgeek’s “spending” amount. From this data, I computed the player cost percentage or “PCP” (the average of Forbes’ player expense and Capgeek’s spending divided by Forbes revenue and yes there could be at least a few jokes or irony with the acronym).

Analyzing the data provides some telling information:

1) Generally, two thirds of the teams fall below the average revenue per team (20 teams in 2011 and 19 teams in 2010) with the lowest team accounting for about 2% of total team revenue while the highest is more than 3x that at over 6%.

2) The largest revenue team had a PCP of 30% while other teams reached as high as 73%. Without the actual data, one might assume this disparity is just a case of extremes and limited to a few teams. Further analysis of the shows this is not the case. In 2011, 53% of the teams in the league had a PCP that was more than twice that of the highest revenue team. When reviewing 2010, it proves 2011 was not an aberration as the same statistic held true for 47% of the teams.

3) The top three teams in operating income average around $58 million per year while the rest of the league averages an operating loss of $780,000 per year.

4) When looking at groupings within the Player Cost Percentage, you can note the following:

5) More than 73% of the teams had operating income of less than $3.3 million with 60% of the teams sustaining an operating loss in 2012. The teams fared better in 2011 with only 63.3% of the teams having operating income of less than $2.7 million and only 53.3% of them sustaining an operating loss.

Does this surprise any of you? Being in a smaller market NHL city, the results were much like I expected. More importantly: what all does this suggest?

1) For 20-30% of the league, there is no need for a salary cap but for everyone else the cap could be critical to sustainability.

2) The same teams mentioned in item 1 dominate the profitability and revenue of the league. By doing so, they drive the salary cap and floor to a level that causes most of the remaining teams to lose money, maybe even calling the long term sustainability of some of the teams into question. In this case, the poor to get poorer as the rich get richer.

3) Historically, the NHLPA has been more than happy with this system because as the large revenue teams keep juggernauting ahead, they force the smaller teams to raise salaries even if their business models can’t tolerate the salary increases. While this is great in the short term as it increases overall NHLPA compensation, it can be very detrimental in the long term. If you don’t believe me, ask some players of the WHA or the ABA who were not able to find a home on an NHL or NBA team.

4) The aforementioned items truly illustrate the need for revenue sharing and it isn’t clear if the existing revenue sharing is included in the Forbes revenue numbers. If it is, I shudder to think what the numbers would look like without it. If it doesn’t I wonder how that would improve the profitability of the lower teams.

5) We can assume the league will use this data to show how a lot of teams are losing money and need the salary cap lowered. The NHLPA will use this to show the overall profitability of the league and illustrate how some teams are doing very well wanting the “have” teams to share with the “have nots” in a larger way while keeping the player’s salary cap climbing. Interestingly, this issue shows just another illustration of the three financial struggles in the NHL – players vs. players; teams vs. teams; and teams vs. players but that conversation is for a later day.

I realize that the numbers presented by Forbes have to be taken with grains of salt and can vary significantly based on how certain revenue is split, especially among related entities but that is a very complex conversation not to be had in this blog especially when we are limited by the data we can obtain. I’ve been giving given the data considerable thought and have been developing my own CBA financial plan, which of course will be ignored by everyone. I’ll post it in a few days to get your comments.

As always, it’s a great day for hockey and here’s to hoping that day continues into the 2012-13 season.

PS - If the finances of the game interest you, please consider reading Bruce Dowbiggin’s book – Money Players : How Hockey’s Greatest Stars Beat the NHL at its Own Game. Realize that Bruce wrote that book in 2003, well before the lockout.

data:

Leave a Comment

You must be logged in to leave a comment.Blog Archive

18 Protective netting: focused on fans or just out of focus

22 How Can I Get My Girlfriend to Like Hockey, the Sequel?

22 How Can I Get My Girlfriend to Like Hockey, the Sequel?

29 ’s Waldo

05 Brian Elliott is Rodney Dangerfield, he gets no respect

09 The Not So Curious Case of Vladimir Sobotka

10 If a tie is kissing your sister, shootout loss points are...

17 NHL to revamp the Draft Lottery. Let's hope it rewards wins

17 NHL to revamp the Draft Lottery. Let's hope it rewards wins

09 The Not So Curious Case of Vladimir Sobotka

10 If a tie is kissing your sister, shootout loss points are...

17 NHL to revamp the Draft Lottery. Let's hope it rewards wins

17 NHL to revamp the Draft Lottery. Let's hope it rewards wins

20 Sorting through the back end part of the roster

21 With the D list partly cloudy, the F roster is densely foggy

28 An hour and a half late and a goal short

30 Afternoon quick hits

30 Blues turn the Hurricanes into a light rain

21 With the D list partly cloudy, the F roster is densely foggy

28 An hour and a half late and a goal short

30 Afternoon quick hits

30 Blues turn the Hurricanes into a light rain

02 Blues tame the Jr. Wild 4 to 1 - updated

06 My opening night roster and lineup prediction UPDATED

12 Dominating bounce back game

23 Miller expected to start tonight

06 My opening night roster and lineup prediction UPDATED

12 Dominating bounce back game

23 Miller expected to start tonight

? i think your blog didnt show up, maybe?

Message Posted

good write up, there is a big disparity between teams due to financials and how they can work within their budgets, how creative they can be and how teams have to be more careful on what they do and who they signits going to be very interesting to see how the new CBA will work and if there will be any/more help for small market teams or if it will remain pretty much the same

Teams in large cities like NY, Boston and Philadelphia will always have more revenues than teams in places like Phoenix, Miami and Tampa.